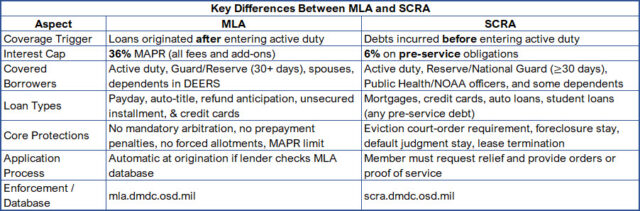

Navigating credit as a servicemember or military spouse can be tricky. Two federal laws—the Military Lending Act (MLA) and the Servicemembers Civil Relief Act (SCRA)—provide crucial safeguards to your financial well-being. While both laws serve to protect you and your financial well-being, they differ significantly in practice and scope. Understanding when they apply and what they cover will help you exercise your rights as a servicemember. Let’s look at these two laws and see how and why they are different, and how they protect you.

The MLA caps the Military Annual Percentage Rate (MAPR) on covered loans at 36%, including interest, fees, and add-on products like credit insurance.

It applies to active-duty servicemembers (including Guard/Reserve on active orders for 30+ days), their spouses, and dependents who enroll in DEERS.

MLA protections cover payday loans, vehicle-title loans, refund anticipation loans, many credit cards, and unsecured lines of credit—but NOT mortgages or other loans secured by the purchased property.

What Is the Servicemembers Civil Relief Act (SCRA)?

The SCRA reduces interest on pre-service debts (mortgages, credit cards, auto loans, & student loans) to 6% per year while on active duty, plus one year for mortgages.

It also prevents eviction for rent under $9,100/month without a court order, halts foreclosures without a judge’s decree, and shields against default judgments when military duty hinders or prevents court appearances.

Additional benefits include lease termination rights, a stay of civil proceedings, and protection against vehicle repossession without a court order.

Tips to Protect Yourself When Obtaining Credit

- Always verify your active-duty status through the MLA or SCRA databases before closing deals.

- Ask lenders to disclose the MAPR on any loan or credit card to ensure it doesn’t exceed 36% under MLA rules.

- For pre-service debts, submit a written SCRA request with your orders to cap interest at 6% and prevent adverse actions on your credit. Many companies have a SCRA department that can help provide you with the steps needed for their particular institution.

- Avoid payday and auto-title loans outside MLA coverage—look for lower-cost installment options on base or through credit unions.

- Consult your base’s Legal Assistance Office or Personal Financial Counselor before signing any credit agreement.

Resources

- Consumer Financial Protection Bureau: Military Lending Act overview – Military Lending Act (MLA) | Consumer Financial Protection Bureau

- Consumer Financial Protection Bureau: Servicemembers Civil Relief Act summary – The Servicemembers Civil Relief Act (SCRA) | Consumer Financial Protection Bureau

- DoD Verification Sites:

- MLA database: mla.dmdc.osd.mil

- SCRA database: scra.dmdc.osd.mil

- Military Legal Assistance Offices (find via your installation JAG)

Protecting your finances starts with knowledge. Lean on these laws—and your base resources—to keep credit costs low and rights intact.

Explore More with My Military Lifestyle and Finances!