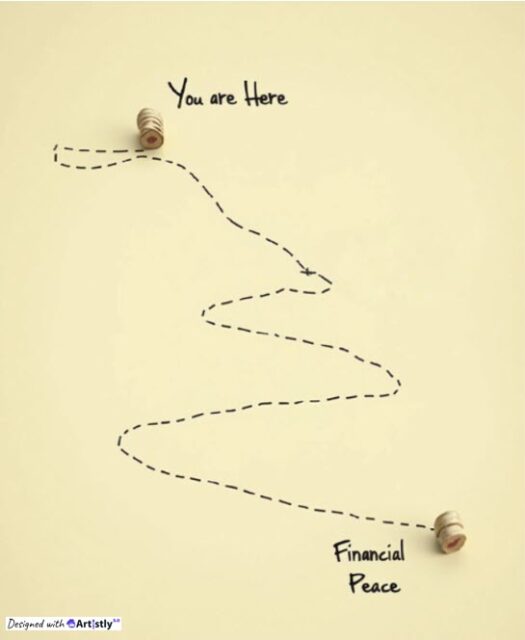

Military life brings changes and movement. PCS orders, deployments, homecomings, and new beginnings are a regular part of military life. With so much change, having a personal financial plan isn’t just a good idea; it’s essential. Think of your financial plan as a roadmap for your financial journey. Whether you’re just starting or planning for retirement, this guide can help you stay on course.

Define Your Destination – And Stops Along the Way

- Every journey starts with a goal.

- For military families, that might include:

- Buying a home near your next duty station

- Saving for your child(ren)’s education

- Preparing for retirement

- Managing debt

- Investing for long-term stability

- These, and other goals, are your financial destinations.

- A clear plan helps you move toward them with confidence.

Know Your Starting Point

- Before you can chart a course, you need to know where you are starting from.

- That means taking stock of:

- This snapshot is your “You Are Here” marker. It helps you build a realistic plan based on your current position.

- To get from where you are to where you want to be, you have to plan a route.

Choose Your Route

- Just like a GPS offers multiple routes, your financial plan lays out the steps to reach your goals:

- Budgeting for everyday life and unexpected expenses

- Saving consistently—even during deployments or transitions

- Investing wisely, whether through TSP, IRAs, or other options

- Paying down debt with a strategy that fits your lifestyle

- Following this route keeps you on track, even when life gets busy.

Expect Detours

- Military families know that flexibility is key. Orders change. Emergencies happen. Markets shift.

- Your financial plan should be just as adaptable:

- Revisiting your goals after a PCS or promotion

- Adjusting your budget if a spouse changes jobs

- Reallocating savings during deployment or reintegration

- Think of these moments as detours—not dead ends.

- With the right mindset, you can reroute and keep moving forward.

Stay Consistent

- Progress comes from steady effort.

- Whether you’re saving $50 a month or tackling a big debt, consistency builds momentum:

- Automate savings and bill payments

- Review your plan quarterly or after major life events

- Celebrate small wins—like paying off a credit card or reaching a savings milestone

- Discipline today leads to freedom tomorrow.

Final Thought for Military Families

Your financial journey is uniquely shaped by service, sacrifice, and resilience. A personal financial plan helps you navigate it with purpose. Like any good roadmap, it evolves with you—adapting to new terrain while keeping your destination in sight.

So take a moment. Check your coordinate, and start mapping your way toward financial peace.

Find Out More with My Military Savings and Finances!