Does the thought of investing intimidate you? It is not unusual for someone to have reservations about investing. It can be scary, especially at first. Let’s look at some of the most common investing fears and then look at some steps you can take to overcome those fears.

Common Fears

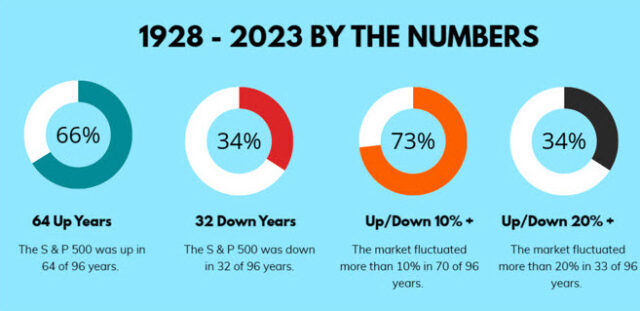

1. Fear of Losing Money: The possibility of losing hard-earned money can be daunting. And real. In the 96 years since 1928, the S&P 500 has been down 32 years. Seven of those years saw losses of 20% or more. That means the market was up in 64 years!

2. Lack of Knowledge: Many people feel they don’t know enough about investing to make informed decisions. The world of investing can be confusing. The world of investing has a language all its own; stocks, bonds, options, puts, calls, bears, bulls, mutual funds, ETFs, among others, making investing principles seem beyond the average person.

3. Market Volatility: The ups and downs of the market can be intimidating. The market has its ups and downs with swings of 10% or more in 70 of the 96 years between 1928 and 2023.

4. Past Negative Experiences: Previous losses or bad experiences can deter future investments. “Once burned, twice cautious” is a reality for many.

5. Complexity: The perceived complexity of investment options can be overwhelming.

6. Fear of Making Wrong Choices: The fear of picking the wrong stocks or funds can paralyze decision-making. Starting with an index fund that tracks the broad market or a target date fund can help you get started. You can add funds or other investments later as you learn and become more confident.

Ways to Alleviate These Fears

1 – Educate Yourself: Knowledge is power. Learning about different investment options and strategies can build confidence. Many free resources can help anyone understand investing and investments. One excellent tool is the Morningstar Investing Classroom with more than 60 courses on stocks, funds, bonds, and portfolio management.

2 – Start Small: Begin with a small amount of money to get comfortable with the process. For retirement investing, start with at least an amount to get your employer’s 401k/503b, or TSP match. Work your way up to 15% of your gross income. For non-retirement investing, consider your goal and timeframe and invest amounts that won’t wreck your everyday finances should the investment not be successful, especially at the beginning.

3. Diversify: Spread your investments across different assets to reduce risk. Mutual funds and Exchange Traded Funds (ETFs) can help you easily diversify.

4. Set Clear Goals: Specific financial goals can provide direction and motivation. Know why you’re investing, your timeframe, and what the plan for the money is for.

5. Know Your Risk Tolerance: Every investment carries an element of risk. Knowing the risks and rewards of different investments, you can select the right investment for your goals and risk tolerance.

6. Seek Professional Advice: Financial advisors can offer personalized guidance and reassurance. A good professional can help you learn about investments and investing, guide you to the right investments, and help you logically manage the ups and downs of the market.

7. Focus on the Long Term: Investing, especially retirement investing is a long-term game. Short-term fluctuations are normal, but the saying, “Time in the market beats timing the market” is true.

By addressing these fears with education, strategy, and support, you can build a more confident and successful investment approach. The U.S. Securities and Exchange Commission has additional resources, along with its sister website Inverstor.gov.

Find Out More with MyMilitarySavings.com and Finance!