Much is written in personal finance articles about the importance of your credit score, but its importance may be overstated. Having a “good” credit score can be helpful when applying for a mortgage or other loan, when looking to rent an apartment, obtaining auto insurance, as 42 states allow your credit scores to be a factor in determining rates and renewals, and sometimes getting a job, but unless you intend to continue to take on new debt, there may be more important “numbers” to devote your time and energy to.

What is a credit score?

A credit score is a three-digit number computed to represent your creditworthiness to a lender. Credit scores range from a low of 300 to a high of 850 with higher scores indicating a higher confidence by lenders that you will repay what you’ve borrowed. Before the creation of the credit score, individual lenders determined creditworthiness on an individual basis by relying on personal relationships with local merchants and bankers as well as character references. With the advent of computers and better communications, creating a credit score process simplified the process for lenders by relying on the numbers as an indicator.

How are credit scores computed?

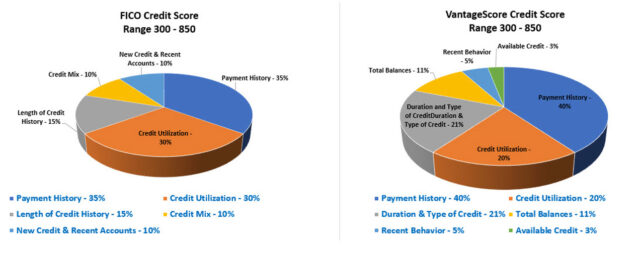

There are two major credit scores used today. The well-known FICO score, a service of the Fair Isaac Corporation, and the Vantage Score, a joint venture of the three major credit reporting bureaus Experian, TransUnion, and Equifax. Payment history, credit utilization (the amount of total credit limit in use), credit history, mix of credit, and recent credit activity make up the factors measured in computing a credit score. While the exact algorithms are trade secrets, we can know the weightings of each factor and how to use them to our advantage, and then we look at how to improve your credit score.

What is considered a good score?

Credit scores are measured in bands as your numerical credit score fluctuates often based on multiple factors and reporting dates. Typical score ranges:

- Poor: Below 580

- Fair: 580- 669

- Good: 670 – 739

- Very Good: 740 – 799

- Exceptional: 800 and above

What are the advantages of a good score?

- Improved loan approval chances – A higher score suggests more confidence in the borrower repaying the loan as agreed upon.

- Lower interest rates – Higher scores indicate you are a better credit risk and that can result in lower interest rates saving you money over the life of the loan.

- Higher credit limits – Lenders are more comfortable lending you more money with a higher score.

- Better employment opportunities – Many employers check credit scores and history as part of the hiring process.

There are several ways to maintain and improve your credit score:

- ALWAYS pay bills on time – Payment history comprises 35 – 40% of your credit score. Even one late payment severely affects your score. Paying your credit card in full monthly prevents late payments, fees, and interest charges while keeping you well below your limit.

- Keep your balances low – Credit utilization (the percentage of your credit limit in use) makes up 20 to 30% of your score. Keeping your balance below 30% of your credit limit helps maximize this portion of your score.

- Maintain older accounts – Length of credit history accounts for 15 to 21%. The longer you keep the account (in good standing), the higher your score. Closing a newer card instead of an older card protects your credit score.

- Avoid opening too many accounts – Each new credit application reduces your average length of credit history and will temporarily lower your score.

- Monitor your credit reports – Many credit reports contain erroneous information. You can dispute errors in your credit history with just a letter or email.

Since we are talking about credit reports, did you know that you can get a FREE credit report annually? It contains information from all 3 of the credit bureaus mentioned before! It is good to check in and make sure that you don’t see anything unexpected on there and to make sure that everything is on track as well!

Do I need a credit score?

There are good reasons to maintain a good credit history and resulting credit score. In addition to the advantages listed earlier, reducing interest and debt payments improves your financial position. The more savings and investments you have, the less dependent on credit you can be. The less dependent on credit you are the less impact your score makes on your life. People who do not use credit can get to the point of having an “undeterminable” FICO score but that is not necessarily a bad thing, and will not prevent them from obtaining a mortgage. Many lenders will do their underwriting to determine your ability to pay a mortgage based on your income, savings, investments, and lack of a bad credit history. Another common misconception is that military personnel with a security clearance must have a good credit score to maintain their clearance. That is not true. While financial mismanagement is an indicator of being a security risk, having a poor credit score and debt is not a disqualifier, especially if the clearance holder has a plan and is taking the appropriate steps to clear up the negative issue. Bottom line: The more financially secure you are the less “need” you have for a credit score. There is nothing in your credit score that indicates wealth. Checking and savings balances and the amount of your investments have zero effect on your credit score, but the opposite can be true. Every dollar you spend propping up your credit score with debt and interest payments is one less dollar you can save and invest.

What other “numbers” are important?

So, if my credit score is not a major factor in my financial life, what numbers should I focus on? Great question!

Everyone should have an emergency fund. When, not if, an emergency comes your way, having money available to cover the expense or lost income will turn an emergency into an inconvenience and allow you to continue your life without major financial disruption. Your emergency fund eliminates the need to rely on your credit cards or borrow money to cover the expense. Having three to six months of living expenses is widely accepted as a good amount set aside.

Another good “number” is some financial cushion in your checking account to eliminate the stress of an overdraft and the resulting fees. We all make the occasional mistake and not tracking our cash flow can result in an unpleasant surprise. The exact amount of cushion is a personal choice based on your income, expenses, and situation, but an extra $25 to $100 in your account offers protection and peace of mind.

Tracking and comparing your net worth a few times a year is a good exercise to ensure your finances are going in the right direction. You want to see decreasing debt and increasing savings and investments over time. Seeing a negative trend can be an indicator that financial changes are necessary. Your net worth is the value of everything you own less the total amount of everything you owe. A simple net worth statement can be just the value of your home and financial assets less mortgage and all other debts, although you may want to include the value of other assets you own including autos, furniture, etc.

Is your insurance coverage adequate? Do you have the right kinds of insurance in the right amounts to protect you? It doesn’t take much wind or water to cause a lot of damage to your home and a minor car accident can result in tens of thousands of dollars in damages and injuries very quickly. Take some time to make sure these numbers are squared away too.

Maintaining a good credit score may be an important part of your life depending on your stage and situation in life, but is not the only number you should focus on.

Find Out More with MyMilitarySavings.com and Finance!

Add comment